Foodstuffs' basket continues to track below FPI in 2026, Bumper apple crop on the way

• Stats NZ records 4.6% annual food price inflation (FPI) in January

• Foodstuffs sees retail prices rise 4.0% year-on-year for their comparable FPI basket of products

• Seasonal produce, olive oil and eggs among January price drops

• Red meat and kiwifruit continue to face global and supply pressures

The Foodstuffs grocery co-ops say one of the strongest pipfruit seasons in decades is delivering standout value and quality for apple lovers, as wider inflationary pressures continue.

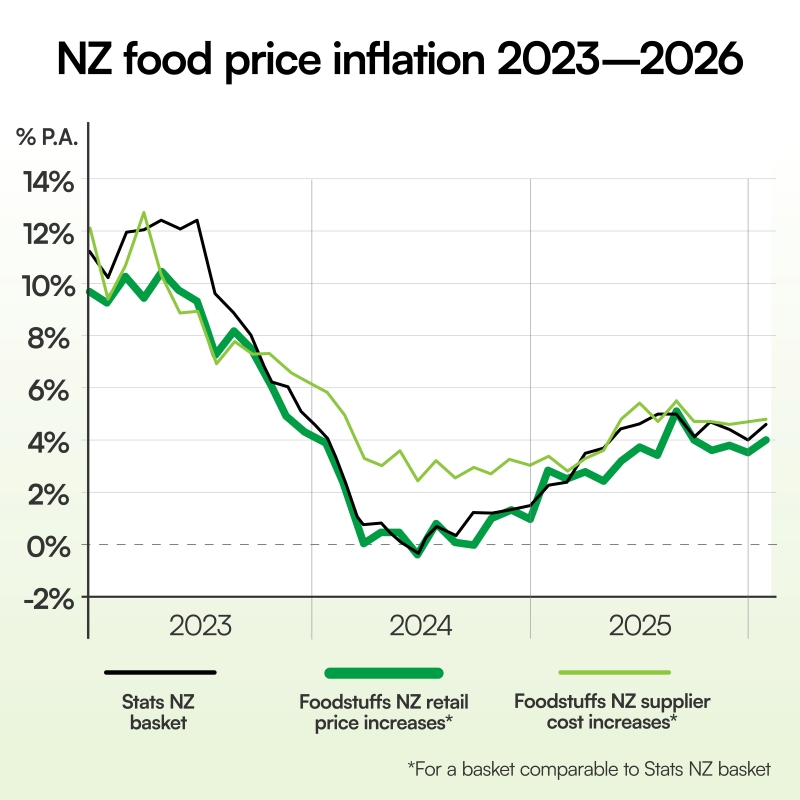

Stats NZ has reported an annual food price inflation (FPI) rate of 4.6% for January, while Foodstuffs recorded an average year-on-year retail price increase of 4.0% across its comparable FPI basket.

Foodstuffs NZ Managing Director Chris Quin says Foodstuffs’ comparable basket has now tracked below Stats NZ’s headline food price inflation rate for 10 of the past 12 months.

“This Stats NZ number is a good benchmark and something we watch closely every month,” says Quin. “It’s good to see that our comparable basket has been under the national food price inflation figure, reflecting the work our teams do to manage costs and pass value through to customers wherever we can.”

While meat and kiwifruit prices remained high due to supply constraints and global demand Quin says a real bright spot of this summer is the bumper apple crop that’s being picked right now.

“Our growers in Hawke’s Bay and Nelson tell us this season is shaping up as one of the best in the past 30 years, with excellent quality apples and strong volumes coming through,” says Quin. “Early season varieties are great buying, and we’re focused on using the whole crop – small fruit is just what you need for back-to-school lunchboxes.

“Royal Gala is still New Zealand’s most popular, followed by the Ambrosia variety, with good old Granny Smith in 3rd place out of a range of more than 30 apple varieties stocked over the season,” says Quin.

January’s year-on-year retail price movements were driven largely by fresh produce, including kūmara (-15.4%), lettuce (-15.0%) and broccoli (-13.2%), while other everyday items also fell, such as olive oil (-18.3%) and eggs (-9.8%).

Quin says the seasonal pricing trend in fresh produce looks to be continuing into February, with apples now joining the list of great value items as volumes grow, with long-term supplier relationships key to supply, choice and quality.

“We’ve partnered with New Zealand growers for decades, and Yummy in Hawke’s Bay is an awesome example of that,” says Quin. “By backing each other and working closely together, we’ve been able to give growers certainty and our customers excellent quality. These connections also enable programmes that make a real difference in schools and local communities.”

Quin says this apple season is looking like a return to better times, after Cyclone Gabrielle devastated the key East Coast growing regions in 2023 – though recent bad weather could impact availability and pricing of other crops over the coming weeks.

“Strong crops make a real difference for growers’ livelihoods, along with the many jobs and communities that rely on them,” he says.

Looking across the FPI basket, protein and a handful of seasonal items are continuing to see upward pressure.

The steepest year-on-year price increases in January were white bread (+62%), kiwifruit (+45.6%), lamb legs (+38.5%), cabbage (+33.0%), tomatoes (+29.3%), meat pies (+27.3%), beef mince (+24.5%) and porterhouse/sirloin steak (+22.8%).

“If you look across our core range of sliced breads, the year-on-year movement is around 5.7%,” Quin says. “Pams remain one of the most affordable options in the category and continues to be a great choice for customers looking for value.”

The spike in kiwifruit prices reflects New Zealand’s strong export success and the need to fill supply gaps with imported fruit ahead of the local growing season, which starts in autumn.

Quin says beef and lamb prices are showing signs of stabilising, despite restricted supply of New Zealand product.

Foodstuffs’ retail price increases were outpaced by supplier costs, up an average 4.8% year on year for products in the co-ops’ FPI basket. The Infometrics Grocery Supplier Cost Index (GSCI), which tracks more than 60,000 goods stocked across the co-ops’ 500+ stores, was up 2.3% in the year to the end of January 2026 (slightly below the 2.4% rise reported for December).

“As New Zealand-owned co-ops, our focus is simple – stock high-quality products that give customers choice and real value,” Quin says. “That means working with local growers and suppliers wherever we can, and sourcing alternatives when it helps keep prices down.”